Okay, so here we are. A client just faxed us on our digital fax. Their number is 88-79. What we want to do is take this 88-79 and put it into our document management system. Then, we will file the return electronically. If we were using Microsoft Outlook, the file would be included here, and we could just grab it from here. We would throw it into DMS under tax returns, and we would be done with that part. This is GoDaddy's email, so you have to go to the email, download it, and once you download it, you get a PDF file to your desktop. That's where I saved this one, and it just has the fax with a number. So, I want to go ahead and rename it. This particular client is just called "1040 client," so we will change it to 2012, which is the year. Their name is "1040 client," and it is form 88-79. Now we have the file, all we have to do is grab it and throw it into tax returns. As you can see, there will be more data here on the sample. But for now, there is nothing in it, just 88-79. We began with the year, the client name, and then it's form 88-79 again. If we were using Microsoft Outlook, we could just grab it and throw it in. At this point, we would be here, and we would just right-click on it, rename it, and we would be done with that part. So, let's go ahead and delete this, because we don't need it anymore. We have now saved it into our document management system, and we're done with that part. Next, we want to go into Intuit Pro Series. Here's our Pro Series account. We have our...

Award-winning PDF software

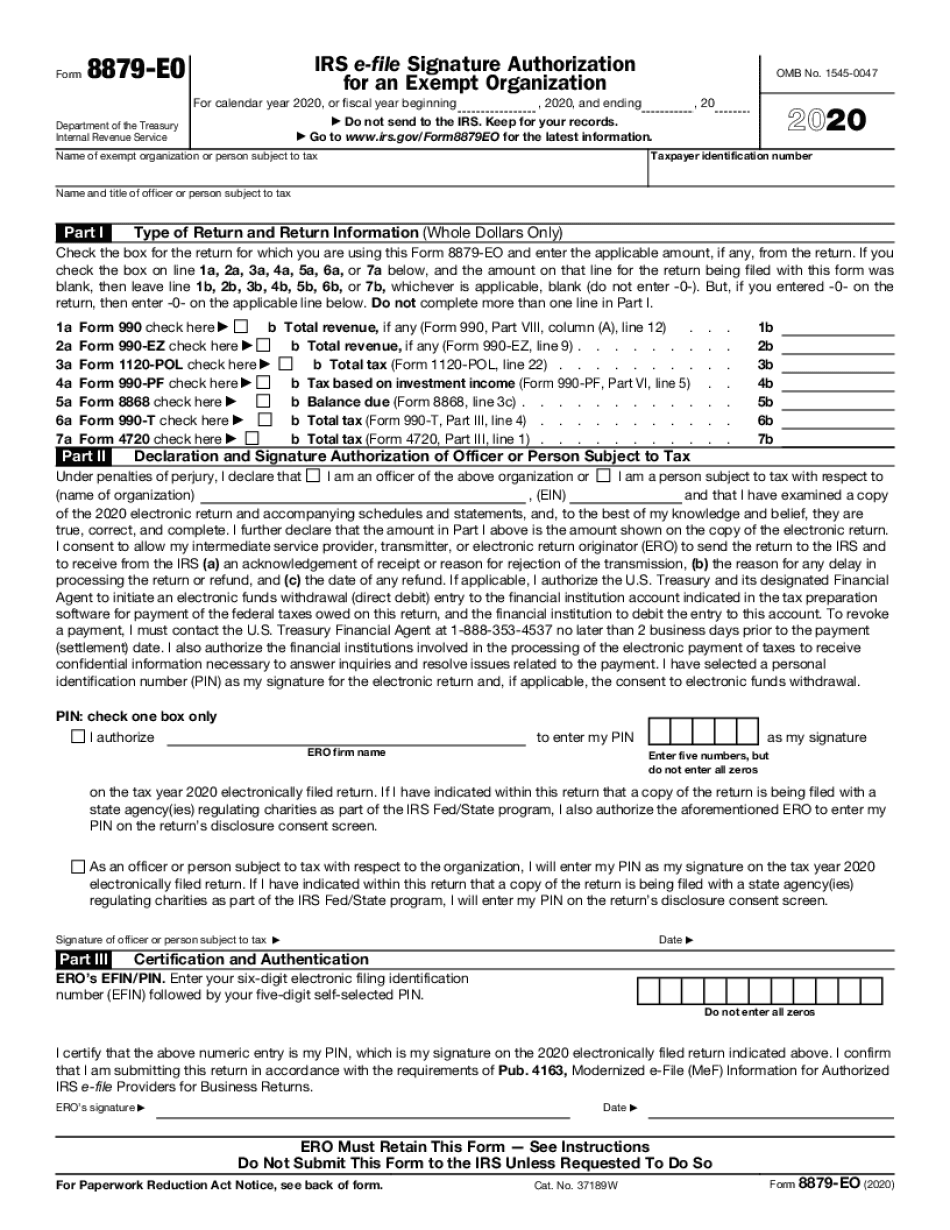

Video instructions and help with filling out and completing Form 8879 Eo