Today, we're going to talk about the W-4. There's going to be a two-part video. In the first part of the video, it's going to be about how to fill out the W-4 to ensure that your federal income tax withholdings are correct. In the second part of this video, it's going to be about the seven mistakes to avoid when filling out the W-4. My name is Travis Sickles, a certified financial planner with Sickles & Or Financial Advisors. The W-4 is the IRS tax worksheet that helps you determine the federal income tax withholdings that your employer should apply to each one of your paychecks. It's essentially an estimate of how much taxes you'll owe on your income. While the IRS hasn't provided the 2018 W-4, they have provided guidance that the 2017 form and any changes they're going to make or guidance they're going to provide can be used with last year's 2017 W-4. If you need a copy of the W-4 or just want to print it out and follow along, I've attached the link below. This is form W-4 for 2017; however, you can still use it according to the IRS. Looking at the guidance from the IRS, and I highlighted it right here, the IRS emphasizes that this information was designed to work with the existing forms W-4 that employees have already filed. So if you've already filled out your W-4 for 2017 or you're just starting out and filling it out now, then you don't have to worry about what form it is. The 2018 form is not out yet. The W-4 is a worksheet that's essentially going to help you figure out how much federal income tax withholdings should be applied to your paycheck. It's going to do that by determining the amount of allowances...

Award-winning PDF software

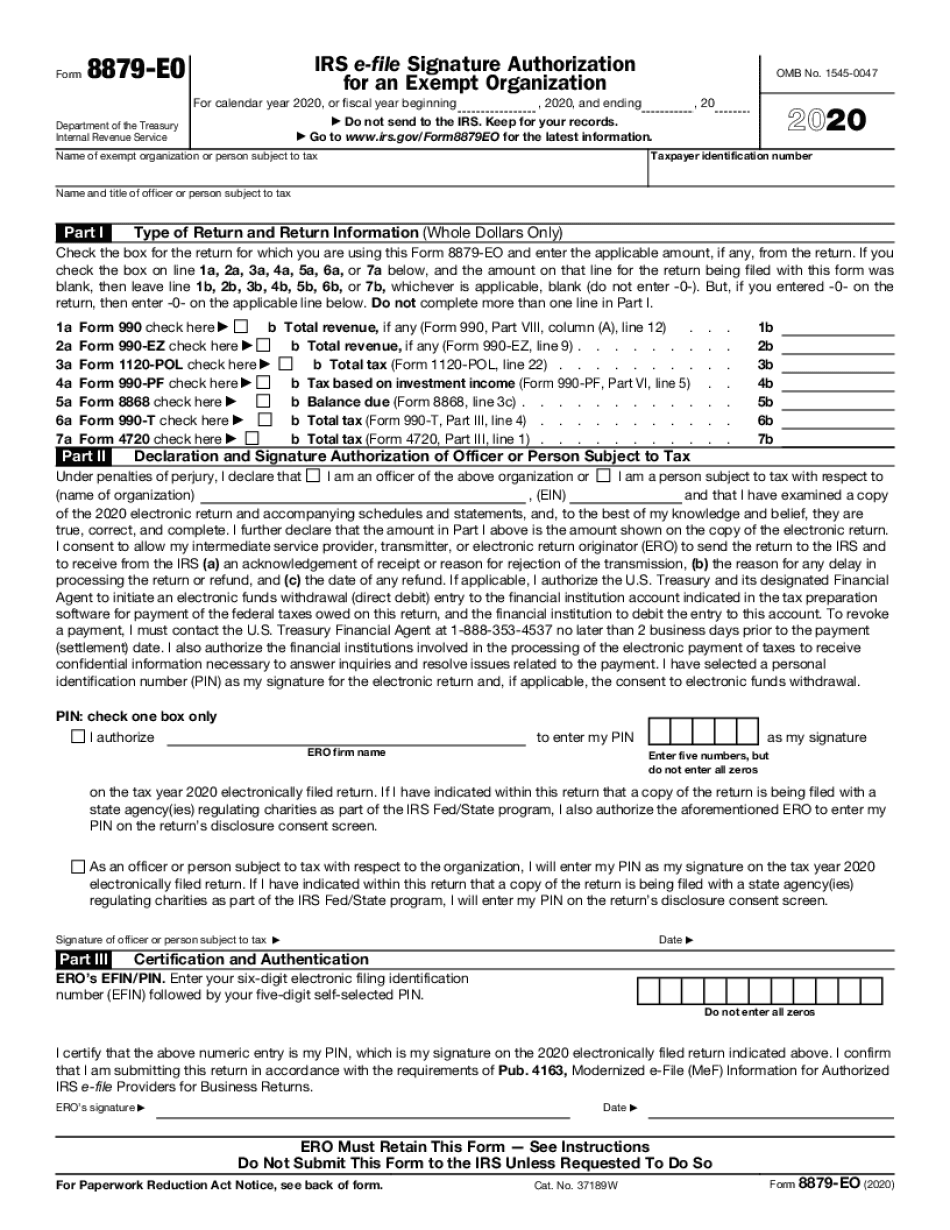

8879-eo 2025 Form: What You Should Know

Signature of the individual who will execute this Form 8879-EO. Oral or written signature; signature of authorized agent or representative. Who will I authorize to execute a form 8879-EO? I authorize you to execute and file this form for the following entity: IRS e-file Signature Authorization for an Exempt Organization Check the box for the return for which you are using this Form 8879-EO and enter the applicable amount. For calendar year 2017, or fiscal year beginning. OMB No. 2025 form 8879 EO: Fill up & sign online — Chub and then add my EO, including: Tax ID Number. Employer Identification Number. Form Number. Address Line 1. Address Line 2. Email. Note that all e-forms are required to be on Chub by April 20th. . . Your e-filing organization will be able to add new Form 8879-EO, but it is not necessary. Form 8938-OFA Who will execute this Form 8938-OFA? I authorize you to execute and file this form for: IRS e-file Signature Authorization for a Franchise Tax Board If you are an Individual, you must apply for Form 8938-OFA at the Franchise Tax Board site here. In most States a paper copy of your EO with your Social Security Number and Signature is required to be submitted. If you are an LLC or COR, the filing requirements will vary from State to State, but an application is not required. All forms, instructions, and supporting documents must be on the same device. All forms are required to be on Chub by April 20th. If you are a Franchise Tax Board, you will need to fill out Form 8938-OFA on your own computer prior to submitting it. Form 8938-OFA 2017 Who will execute this Form 8938-OFA? I authorize you to execute and file this form for: IRS e-file Signature Authorization for A Foreign Corporation; or I authorize you to execute and file Form 5941-OFA. For State, Local or Federally registered organizations, including a non-Federal entity you must sign or mail a letter of request to your tax administrator.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879-EO, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879-EO online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879-EO by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879-EO from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8879-eo 2025