Hi, my name is John Mashney and I'm an attorney at Foster Swift. Today, I thought I would address a question that I get quite often. Unfortunately, I often receive this question when it's already too late to take helpful actions to solve the problem. The question revolves around nonprofits and tax-exempt organizations, specifically whether they must file a Form 990 every year. Generally, nearly all tax-exempt organizations are required to file a Form 990, also known as an annual information return, on a yearly basis. In fact, I would say that if you are not aware of a specific exception exempting you from filing a Form 990, you should assume that you must file. Now, let me explain why this is so important. Generally, a tax-exempt organization does not owe taxes unless it has unrelated business income. However, even if there is no unrelated business income, you still need to file the Form 990. It serves as an informational return that goes to the IRS and provides details about your revenue, expenses, and other relevant information. Filing the Form 990 on time is crucial because failing to do so can result in significant financial penalties. Furthermore, the IRS has an automatic revocation program. If you fail to file the Form 990 for a certain number of years, the IRS will automatically terminate your organization's tax-exempt status, without any prior notice. For a 501(c)(3) organization, losing tax-exempt status means that your donors are no longer able to deduct their contributions to your organization. Additionally, during the period in which your tax-exempt status is terminated, you would be required to pay taxes and file separate tax returns. This could create a considerable tax burden for large tax-exempt organizations. Not only would your organization face financial consequences for not filing the Form 990, but it...

Award-winning PDF software

990 ez 2025 Form: What You Should Know

Form 990-EZ 2025 — The Brain Recovery Project OMB No. . Return of Organization Exempt From Income Tax. Form 990-EZ. Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. 2016. Telling the not-for-profit story through Form 990 Sept 1, 2025 — A new IRS publication titled The Brain Recovery Project “Excelsior” makes it easy for nonprofit leaders and the public to quickly obtain tax information. This new publication provides IRS with the ability to provide taxpayers with more relevant answers to their questions, while reducing the burden from the time and effort that tax software development takes to develop a question-and-answer format. The release of this new publication enables the public to access a variety of tax information such as an organization's name, address, fiscal year, fiscal year ends, and income information. The publication can also provide information about tax-exempt status, if the organization is conducting business as a 501c4 nonprofit organization and its expenses. Form 990-EZ — (Schedule A) October 15, 2025 — The new Form 990-EZ is now available and can be obtained from IRS.gov at. A new report has also been released and provides more information on the form as it pertains to the IRS organization. In addition, the U.S. Senator Claire McCaskill (D-Mo) has called upon Congress to pass legislation to require companies that use tax havens to disclose to the U.S. government the names of those companies. Form 990-EF — (Schedule H) December 6, 2015- Form 990-EZ can help you comply with all taxation requirements. However, when filing your tax return, it may become necessary to send us the following information: your Form W-2, your wages, if you have them, Form W-2G, Social security numbers of the worker and spouse, and Forms W-2C, Forms W-2D, and the last year's pay stubs for the worker and spouse.

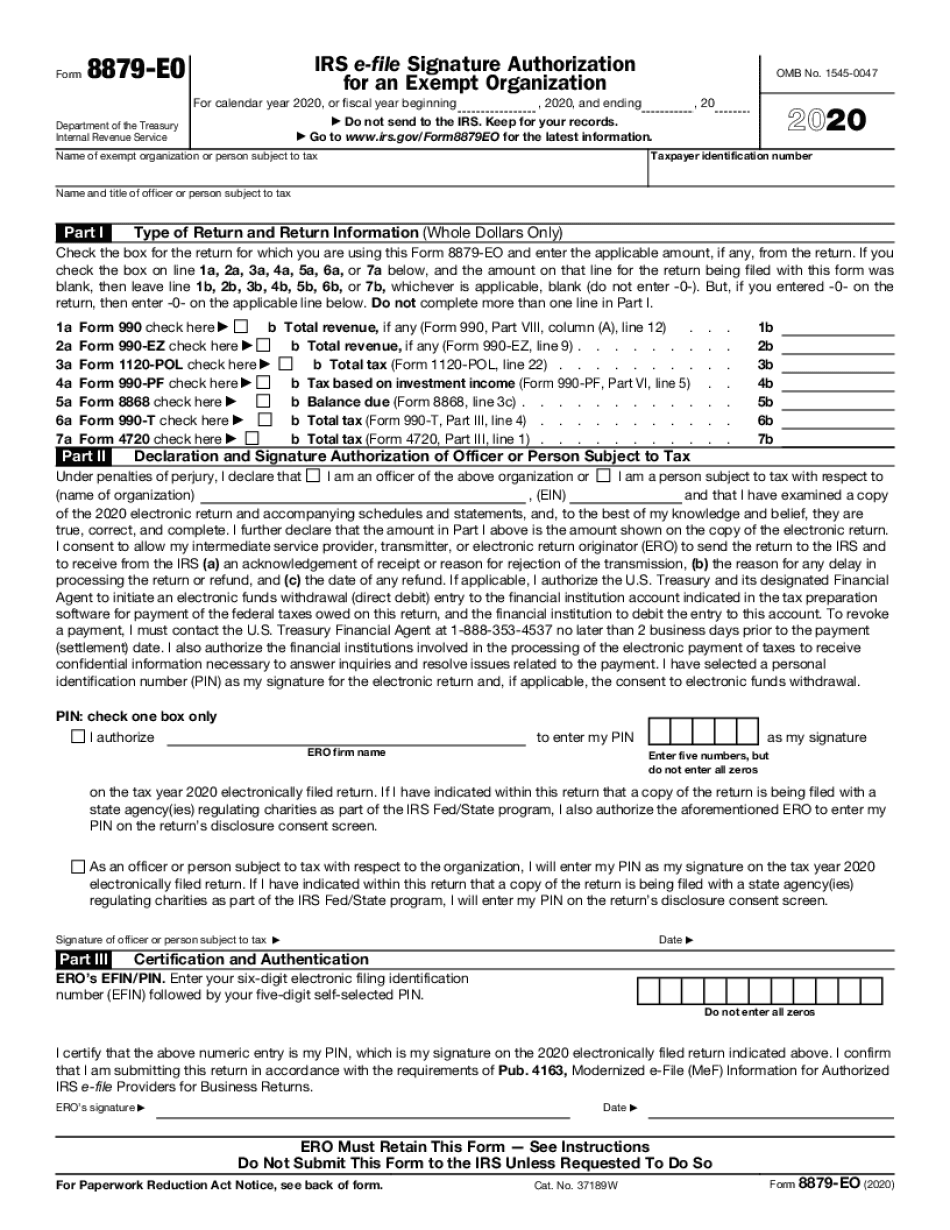

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879-EO, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879-EO online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879-EO by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879-EO from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 990 ez 2025