Hi everybody, this is John from USA Mundo. Welcome back and thanks for watching. Official first time on my channel. As always, welcome! Today, I have another video for you guys. On to this video, it is Creative Friday, episode number 22. In this episode, as always, I'm gonna answer a question. One of my subscribers sent me on YouTube. If you want to know what the question is and my answer, just stay tuned and I'll be right back. USA Mandir Obey Me sent me this question on YouTube. Hi, name of the requester is Patricia. No name or intending immigrant filling for my two-year-old. Thank you. Hello babes, they sent me, and thanks for your question. No, first of all, this is not legal advice. So, your question, it's on you. Fill it up the form. I-64W for your child who is two years old and wondering if you're gonna put your name as the requester or the child's name as the requester on that form. So, for some of you guys who don't know what I-64W is, it's a request for exemption for intending immigrant affidavit of support. Okay, let's say you have a child who is under 14 and you petition for that child. So, that child doesn't have to fill up the form I-64, I mean I-64W, instead, which is kind of like an assumption form. Okay, so not only child, but an adult who lives in another state of America who can prove that he or she worked out on 40 quarters, which is roughly ten years of work in the United States of America, can fill up that form I-64W as well. So, to answer your question, the name of the requester is the name of the intending immigrant. If known, the name...

Award-winning PDF software

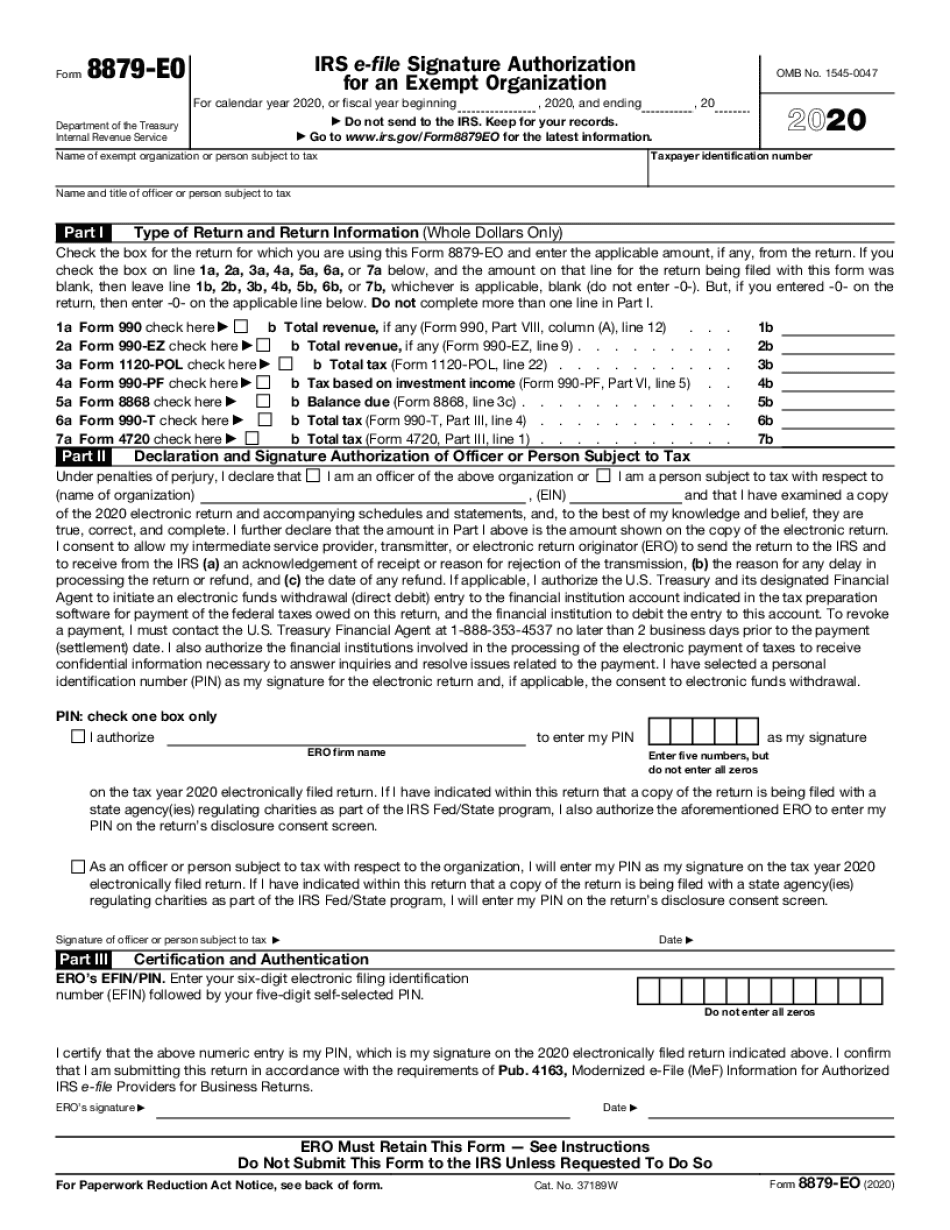

Eo Form: What You Should Know

Category 4 filers, along with the other category 4 filing types, are required to include in their 5471 Schedule M the CFC's estimated gross income for the year. In order to properly account for income from an entity (and thereby comply with Section 8), the CFC will have to account for all the income sources from its business interests. This requires filing Form 1095, Schedule N. The Form 990 Schedule or the 5472 Schedule M, the annual return for the CFC's gross income has to be submitted if the CFC has any foreign source income and a 1098-T is issued. The purpose of the 1098-T is to provide IRS (and other IRS authorized taxpayer agencies) with information regarding the gross income of the CFC during a given reporting period. Form 990 (Form 990-EZ) and the Form 998-T for each year to be filed will be separate. The Form 990 may be updated electronically (by filing a Form 990-EZ-EZ, Form990-L, etc) or mailed (by first requesting a “paper” mail-in (for all Form 990-EZ-EZ, Form 990-L, or Forms 96, 97, 99, 100, 101, 102, 103, 104, etc), and then by checking a box to report the Form 990 is available by “electronically”. This is helpful in that any information about the income earned abroad can be entered if the individual is able to check the box. To ensure your form is submitted with the correct information, it is highly encouraged that you send (by mail or electronically) your Form 990-EZ or Form 990 when you file, for that year. The following charts present various kinds of Form 990 Schedule M, depending upon the reporting period. There are many types of Form 990 Schedule M and these charts illustrate the types based upon the reporting period. Generally an itemized list of income and expenses reported may be provided in the Form 990. Additionally, for categories, the 1099, 1099A, 1099M or 1099P may report the type of income and expenses, and the tax year will typically match up with the reporting period. For a simplified listing, you can review the 5471 Schedule M (Schedule M).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879-EO, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879-EO online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879-EO by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879-EO from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Eo form