Hey folks, this is David McCree, a CPA and the nonprofit tax guy. Today, I want to talk to you about whether you should request an extension of time to file Form 990, even if you don't think you're gonna need more time to file. You know, it's long been thought that requesting an extension reflects poorly on your organization or that it increases your chances of an audit. And in the 20 years I've been doing this, I have not seen any evidence of that at all. Many excellent organizations request an extension every year, but many don't. Many don't need it. So let's talk about what might be the advantages to filing for an extension, even if you don't need one. The IRS has recently made some changes to the way they process Form 990, 990-ez, and 990 PF. This was one of their exempt organization email updates as of January 8th. The IRS is returning Form 990 series returns filed on paper and rejecting electronically filed returns when they are incomplete or if they're the wrong return. It used to be that if you filed an incomplete return or a return that wasn't signed properly, the IRS would just send you a letter and say, "Hey, you forgot to include Schedule A or Schedule B, or whatever. Please send us the complete schedule that was missing within 30 days." Well, now, now they just flat out reject the return. If it's an electronic return, they reject it and you have to fix it and resubmit it. If it's a paper return, they then actually mail it back to you with a letter saying, "You know, complete the return properly and send it back to us within 10 days." Okay, it used to be they would give you 30...

Award-winning PDF software

990 due date Form: What You Should Know

Reminder: Tax-Exempt Organizations Must File IRS Form 990 Reminder: Tax-Exempt Organizations Must File IRS Form 990 Reminder: Tax-Exempt Organizations Must File IRS Form 990 REMINDER: Tax-Exempt Organization Must File IRS Federal Tax Return Reminder: Tax-Exempt Organization Must File IRS Federal Tax Return Reminder: Tax-Exempt Organization Must File IRS Federal Tax Return Reminder: Tax-Exempt Organization Must File IRS Federal Tax Return.

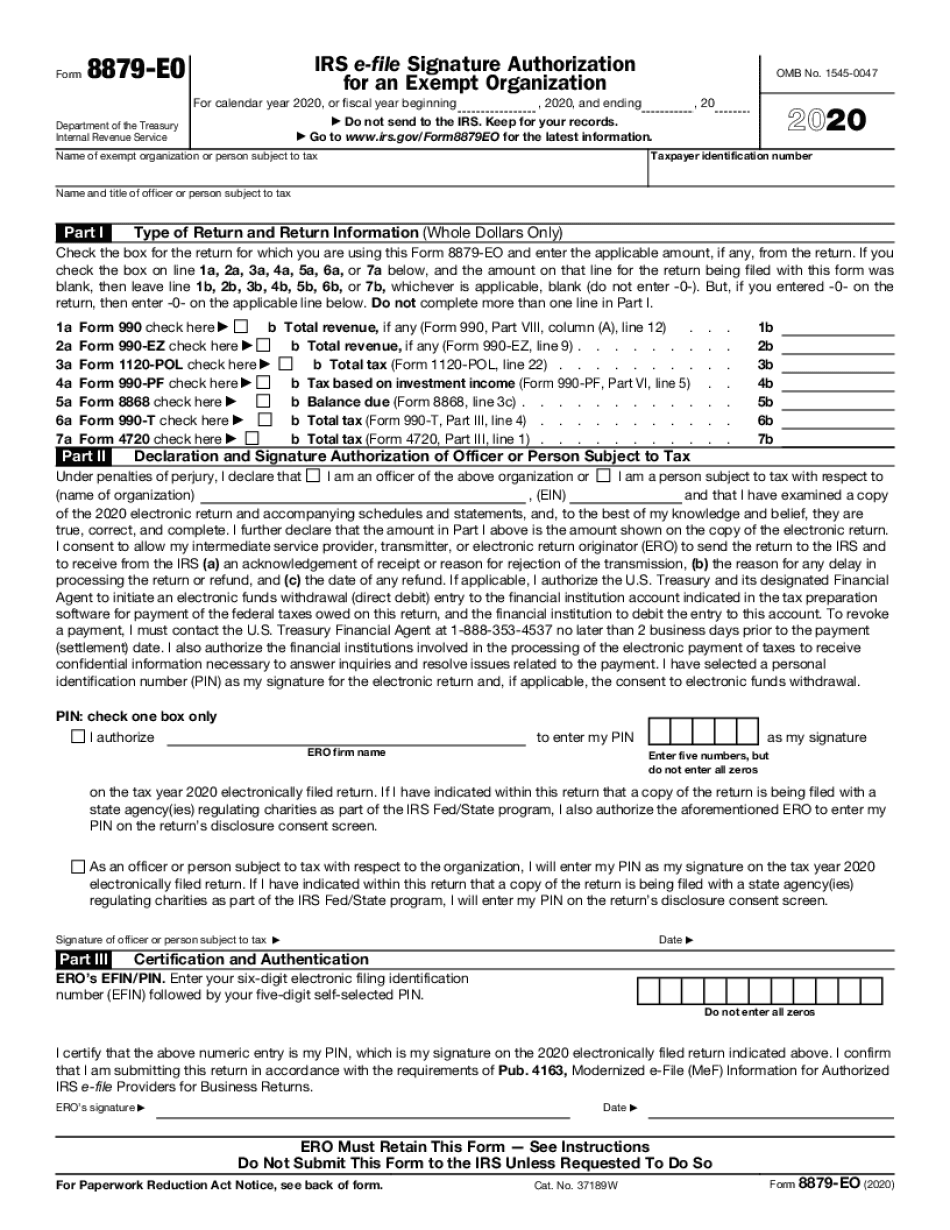

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879-EO, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879-EO online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879-EO by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879-EO from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 990 due date