Award-winning PDF software

form 8879-eo - internal revenue service

To calculate the exemption, first make sure the total contributions from the total contributions section of Form 8879-EO and the total receipts from the total receipts section of Form 8453-EO add to no more than 2 times the exemption amount. Include the amounts from the totals from Form 8879-EO and Form 8453-EO in the exemption calculation on line 2a on Schedule H (Form 1040). The total exempt amount is divided by 2 to find the exemption factor, and the result is multiplied by the exemption factor to find the amount of the additional tax to which the organization, or a member of the organization, is entitled under the law. The percentage is the exemption factor times the amount of the exemption under the tax law the organization, or a member of the organization, is entitled to. Any excess exempt amount is added to the excess exempt amount from line.

form 8879-te - internal revenue service

Form 8949, Election to Be Exempt From Income Tax, also applies to certain LCS, S-Corporations, and Partnership FLL's. An LLC, S-Corporation, or Partnership FLL that elects to be exempt from this tax may be required to file additional tax documents. An LLC or S-Corporation that is not filed Forms 8829 or 8949 is subject to tax on all the income that the LLC, S-Corporation, or Partnership FLL received during the tax year. An LLC, S-Corporation, or Partnership FLL is allowed to withhold and pay the required taxes on its portion of the corporation or partnership income. For more information, refer to Publication 587, Tax on Unearned Income, or visit your local tax office. If an LLC that is exempt under Section 501(c) of the Internal Revenue Code, Inc. must pay federal personal income tax on its income derived from a personal service arrangement. When deciding whether your tax situation is exempt under.

What is considered a "complete" form 990?

What are the penalties for filing and/or using fake driver's licenses? 8453-EO: “A person who knowingly, unlawfully, or fraudulently files or uses, or causes another to file or use, a driver license or identification card using false information, knowing such information to be false may be convicted of a Class D violation under paragraph (k) of this section. “ 8479-EO: “A person who knowingly, unlawfully, or fraudulently files a personal identification document to obtain a driver license or identification card will be subject to a Class D traffic violations citation for the offense of operating an unregistered vehicle or commercial driver license, as determined by the court based on the criteria outlined in paragraph (n) of this subsection. “ 940-7-3: “Any person who, with knowledge of the falsity of the information contained in the record provided in this section, knowingly, unlawfully, or fraudulently uses or.

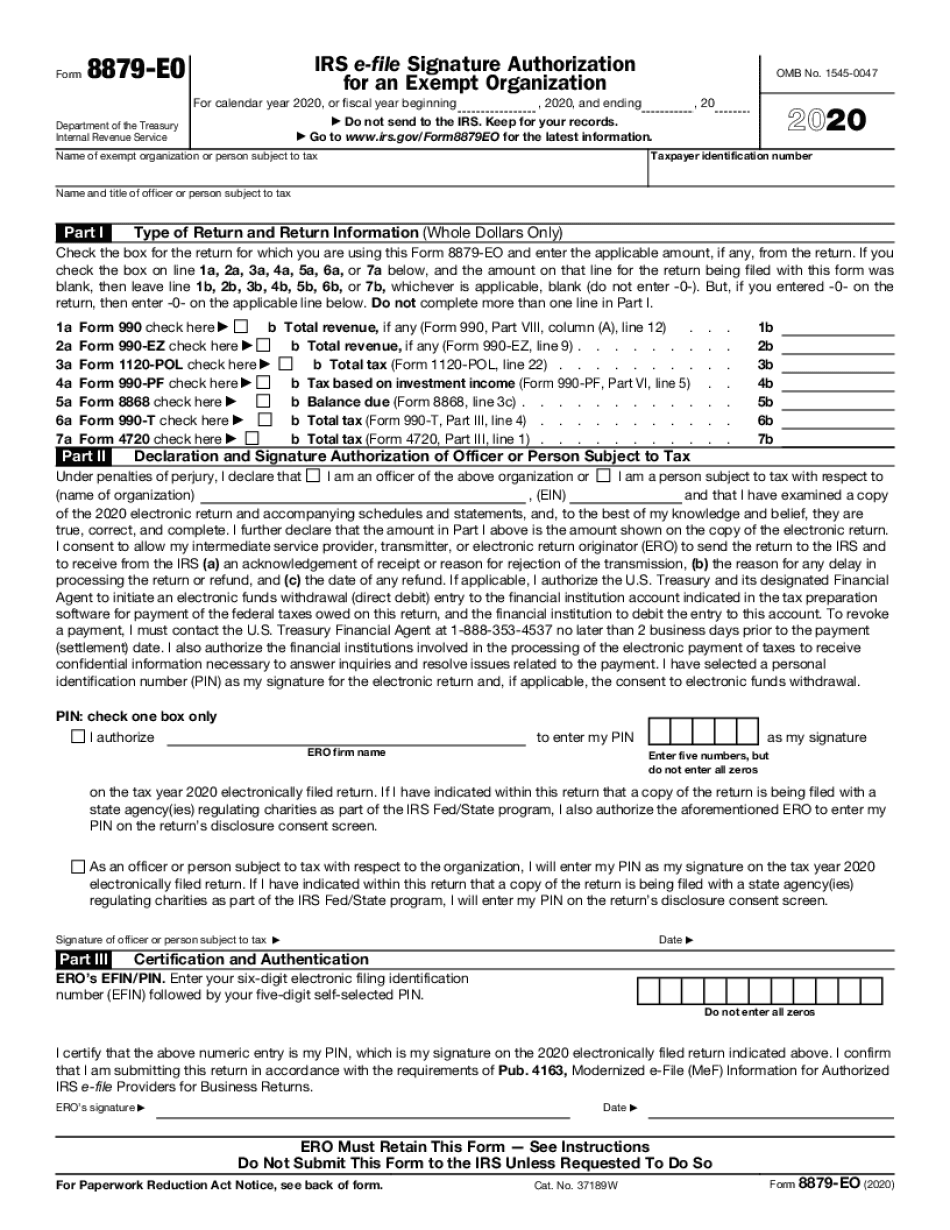

e-file signature authorization for an exempt organization 8879

If you plan to submit the Form 8879-EO to a state that has a return deadline of April 15, you need to check the box for the required state return (which is not applicable for the return deadline of June 22) and press the Submit button. If you plan to submit this form via mail, you do not need to check the box for the required state return and submit by mail. This is because the state return is already included on the form, and you can submit it online. If you plan to submit this form via fax, you can check the box for the required state return and send the form via fax by filling out and submitting Form 8879-FF. If you would like to submit the return to the state of Guam, Guam only, you can check the box for the required state return and select any.

e-file signature authorization form 8879-eo for an exempt

The amount shown for the return also includes the tax paid on the amount that you reported as other income on Form 8959. Enter the amount under the “Other income (Form 1040)” heading. Box 1. Type of payment. Enter any of the following payments. A. Tax withheld from your deposit. If you made a deposit of 100 or less, enter the least of the amount in box 2 of your Form 8802 or, plus 2 percent of the amount withheld and deposited, shown on Form 1040, line 5d., shown on Form 1040A, line 32, or shown on Form 1040NR, line 26. If you made a deposit of more than 100 but less than 1,000, you must use box 1 of Form 8802. If your deposit is less than 10, and you are reporting the actual amount of tax withheld, enter zero in this box without checking any.