Award-winning PDF software

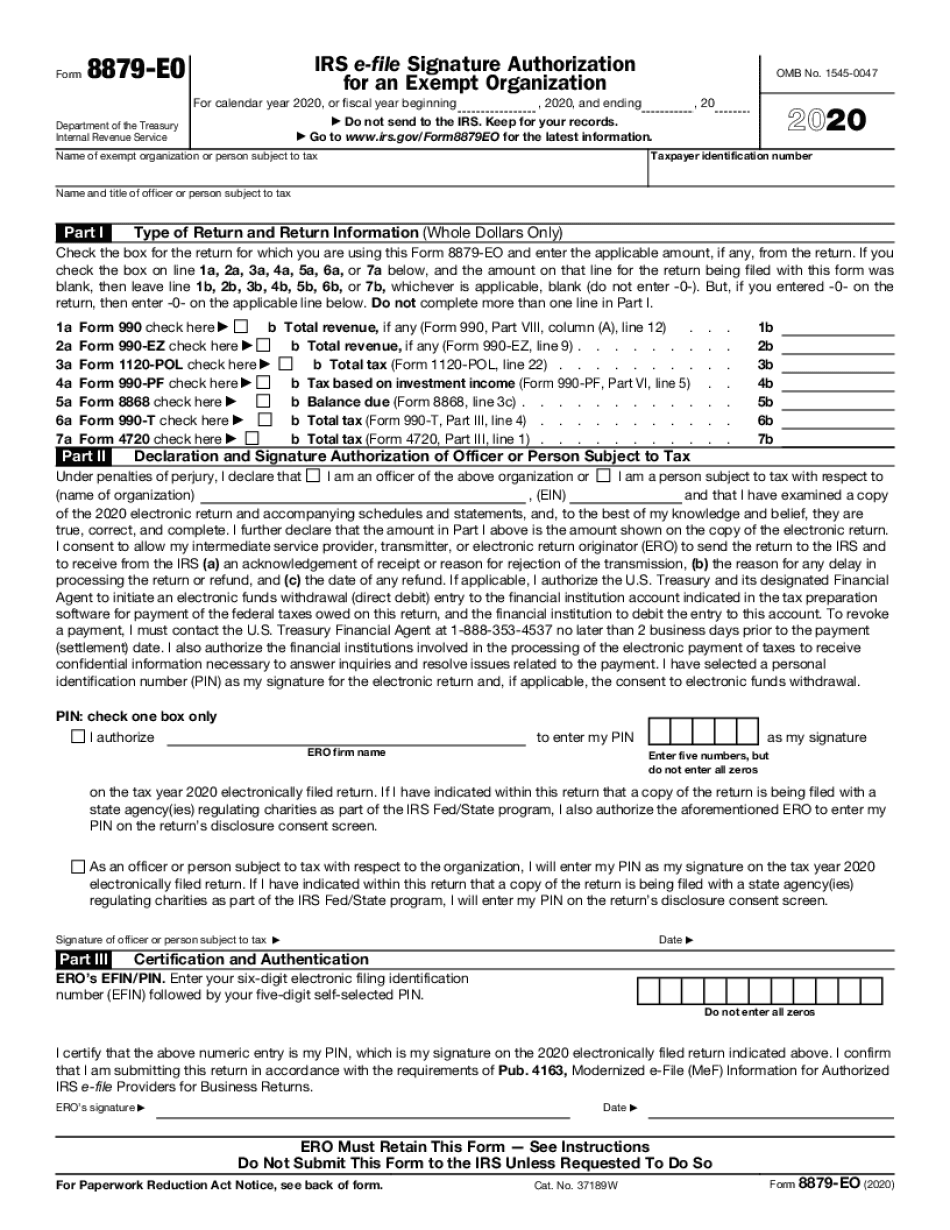

Form 8879-EO for Austin Texas: What You Should Know

St taxable year — taxable year begins January 1, 2nd taxable year— taxable year begins January 1, 3rd taxable year— taxable year begins January 1 4th taxable year— taxable year begins January 1, 1st of each succeeding year. 3. RE: THE STATE RETURN. (A) The state of Texas is the Taxpayer. (B) The purpose of this Texas return, for the Texas taxpayer, is to figure the amount of state tax that is due on the payment made on behalf of the Federal IRS. Please consult with your attorney as to where you should keep your records of this tax return. Payment may be by check or money order. Please check the correct spelling of the name and address. The Form must meet the IRS form requirements. Please indicate any change to form number in column C below or in column (B) above with a '' and your new information. The return should appear in the mail within 30 days unless the IRS says otherwise. If you want to include other documents with your return, please send them with your check. The Texas Department of Transportation may charge a fee for processing your return. Please note that the Texas Department of Revenue does not handle the filing of Federal tax returns, but we do handle all State of Texas tax returns. Form 8879-EO is not a taxpayer preparation tool, but a return to be filed by a Texas taxpayer. If you want to save time, send in your return as early in the year as possible to get the most benefit out of Form 8879-EO and a copy of the Form 1040 EZ. Income and expenses are based on amounts derived from wages or business. Taxes may have been incorrectly withheld. This includes taxes you paid to government offices other than the IRS or other governmental entities; income taxes; capital gain taxes; state and national sales taxes; estate taxes. Income and expenses are the same as reported on the return. For purposes of determining capital gains if you are a resident alien you may be able to reduce the tax due by capital losses arising from the sale of stock you owned in a partnership, limited liability company or trust before or as part of your income for your taxable year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-EO for Austin Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-EO for Austin Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-EO for Austin Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-EO for Austin Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.