Award-winning PDF software

Form 8879-EO online Bakersfield California: What You Should Know

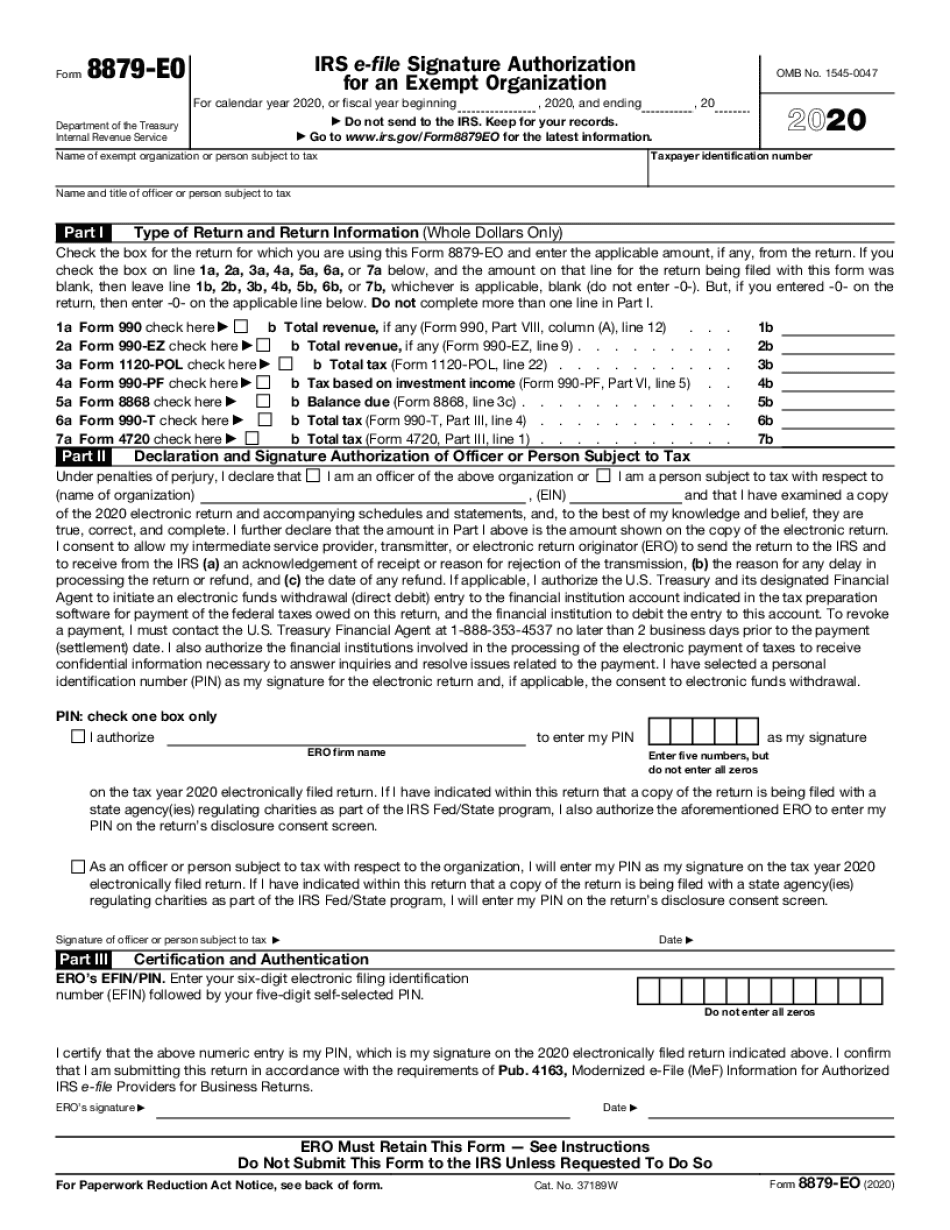

Part II. Form 8879-EO (Complete For Each Filed Return). Enter the following information: Name of Exempt Organization (or Exempt Organization and Its Affiliated Entities if the return is for an organization, or Form 8879-EO, Exempt Organization Declaration): Business Name (Explanation of the name(s)): Business Type (Business Entity, Inc., or Partnership, or a Sole Proprietor, LLP, or a Limited Liability Company): Date of Acquisition of Business(s) (Including date the Business acquired the property or service which is the subject of the form): Date of Incorporation (Include the date of the formation of the business and any later amendments thereto): Name of Business Entity to Form 8879 (Form 8879-EO will not be accepted if the Business Identifies only one entity): Business Entity Identification Number (Form 8879): First name (or, if Form 8879-EO only, first initial): Last name (or, if Form 8879-EO only, last initial): Title, unless stated otherwise Address of Head Office: Business Address (Form 8879-EO only): Telephone Number: Exempt Organization Location: Business Entity City: Part III. Form 8879-EO (Additional Information). Enter the following information on the back of Form 8879-EO: Business Tax Status (Including: Business EIN), Section of tax return: State of Formation of Business Entity: Business Entity Number and Employer Identification Number (if applicable): Account Holder. (If any tax information is not available for an individual taxpayer return, complete Form 8879-EZ and attach it, along with the appropriate attachments as described in section I. D) (You will need to attach Form 8879-EO electronically). Part IV. E-File Required I certify that the above numeric entry is my PIN for the e-file, for the return for which I am using this Form 8879-EO. I have read and understand the instructions for Form 8879, the instructions for Forms 8809, and the information in Part II of this Instruction Guide. I understand that E‑file is necessary and that using an E‑file is the better choice in terms of the timing of receipt of any tax liability. Furthermore, I have determined that the electronic filing method is the more convenient way to file. Furthermore, I certify that (1) I am a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8879-EO online Bakersfield California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8879-EO online Bakersfield California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8879-EO online Bakersfield California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8879-EO online Bakersfield California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.