Award-winning PDF software

West Palm Beach Florida Form 8879-EO: What You Should Know

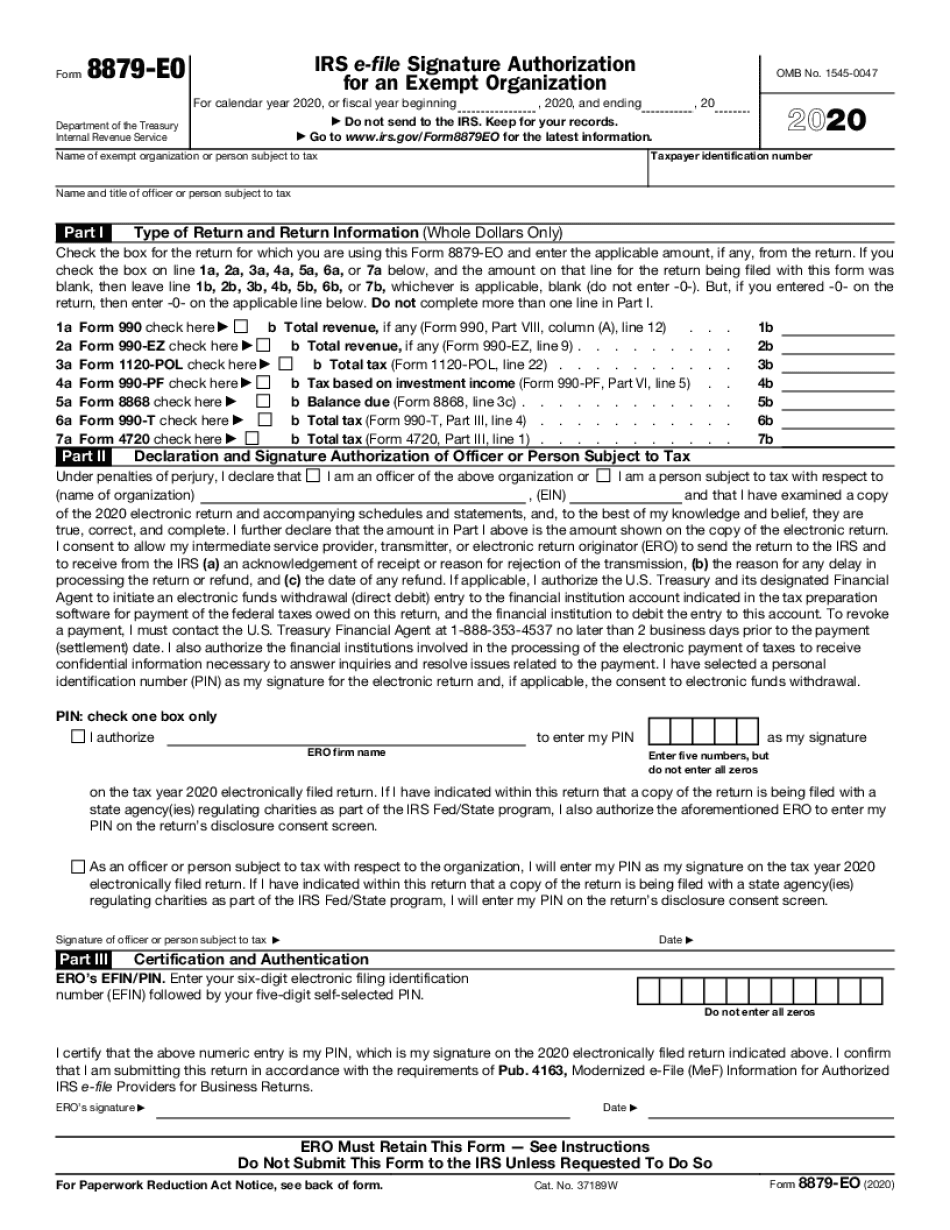

J.A. M. JOHANSEN, JR. JUL 31, 2020. Tax-exempt status: Church of the Nazarene of Palm Beach County. Church of the Nazarene is a religious organization recognized by the Internal Revenue Service (IRS) and is tax-exempt under section 501(c)(3) of the U.S. and State laws. The Church operates its property as a nonprofit educational and charitable organization. The Church was chartered by the State of Florida as a Church. No part of the net earnings of the Church may be used for political purposes. The Church requires that a majority of its board of directors meets in person. The Church was incorporated on Dec. 17, 1990 by the State of Florida in accordance with chapter 784.1 of the Florida Statutes. The Church has five principal offices: West Palm Beach: P.O. Box 150 West Palm Beach, FL 33410. Palm Beach: P.O. Box Palm Beach Gardens, FL 33410. Lincoln: 3175 S. Lincoln Hwy. Suite 705 Lincoln, NE 68623. The Church is the subject of an examination and investigation by the Office of the Inspector General of the United States Department of Homeland Security. The investigation was initiated on Oct. 1, 2025 and has as its object the investigation and ascertainment of whether the Church of the Nazarene of Palm Beach County (hereinafter “Church of the Nazarene”) is in furtherance of foreign terrorist activities, and has the ability to do so for a period not to exceed one year from the date of determination. The IRS, in accordance with the requirements of the Internal Revenue Code, has requested additional information from the Church. If the IRS is unable to obtain information from the Church, it will continue to obtain similar information as is reasonably necessary to further the investigation. For a detailed description of the Church of the Nazarene and any allegations, please review the attachments to the Form 8879-EO. Please complete and sign this form and return with payment, Form 1120-SEP-C-1082, to The IRS at : 101 North State Street Washington, DC 20549. You may be required to submit additional documents. For further information, please contact the Church of the Nazarene directly. Please note: The Church of the Nazarene is a nonprofit educational organization.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete West Palm Beach Florida Form 8879-EO, keep away from glitches and furnish it inside a timely method:

How to complete a West Palm Beach Florida Form 8879-EO?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your West Palm Beach Florida Form 8879-EO aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your West Palm Beach Florida Form 8879-EO from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.