Award-winning PDF software

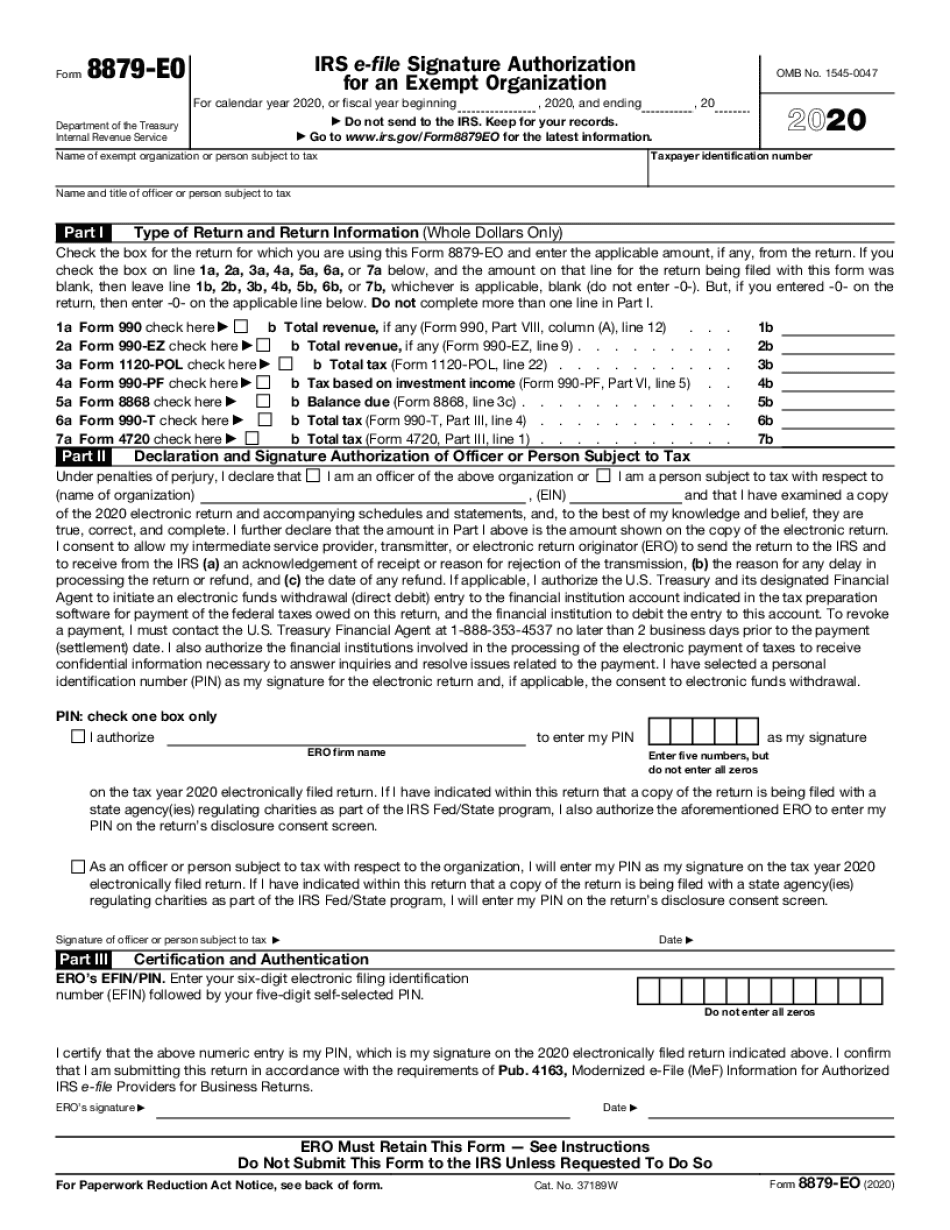

King Washington Form 8879-EO: What You Should Know

E-FED. Form EFT-2 from a bank or other financial institution. Form 8501 (from your broker). For Form 8447, see also Form 8824. (1). Fiduciary — Use Form 8802 (and the Schedule A) when transferring amounts to and from your broker. See Form 8802. (2) Deposit — This is another way if your broker doesn't ask for this Form, write for a financial institution or other person to make the actual deposit. See Form 8802. Electronic funds. Electronic funds transfer — A transaction in which information (such as a deposit or withdrawal, a credit check, or a purchase or sale between financial institutions) is transmitted electronically. This can be a bank transfer, a check, or a withdrawal. To use electronic funds transfer, an individual must have a valid Social Security number, or the information must be entered on a Form 1099-P. However, in certain circumstances, an individual may be able to obtain his or her own card through a bank or financial institution. If an individual receives a cash advance on a card, this is treated like any other advance of cash. The individual will only be liable for the excess amount of funds received. See the chart below. The credit on the check will be canceled if the card is subsequently used for purchases of cash, goods, or services through a financial institution. See IRM 25.3.6.6.2, Cardholder's Responsibility for the Application of Credit Conditions For nonbank, nonfinancial institutions, see Bank, Financial Institution, or Nonbank institution — A Nonbank, Nonfinancial Institution, above. If the check is deposited by the financial institution in the account in which you receive the cash advance, no liability is imposed under IRC Section 6512(a). The amount deposited in your account is considered to be a cash advance, even if it is returned to the financial institution. See IRC 6512(b). Even if the financial institution cancels the advance on your account, you still have a claim for the amount deposited in your account. See IRC 6512(c). The following applies to nonbank, nonfinancial institutions when you deposit money to a beneficiary (other than your child who isn't a dependent at the time the advance is paid), whether that beneficiary is a parent or grandparent.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 8879-EO, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 8879-EO?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 8879-EO aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 8879-EO from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.