Award-winning PDF software

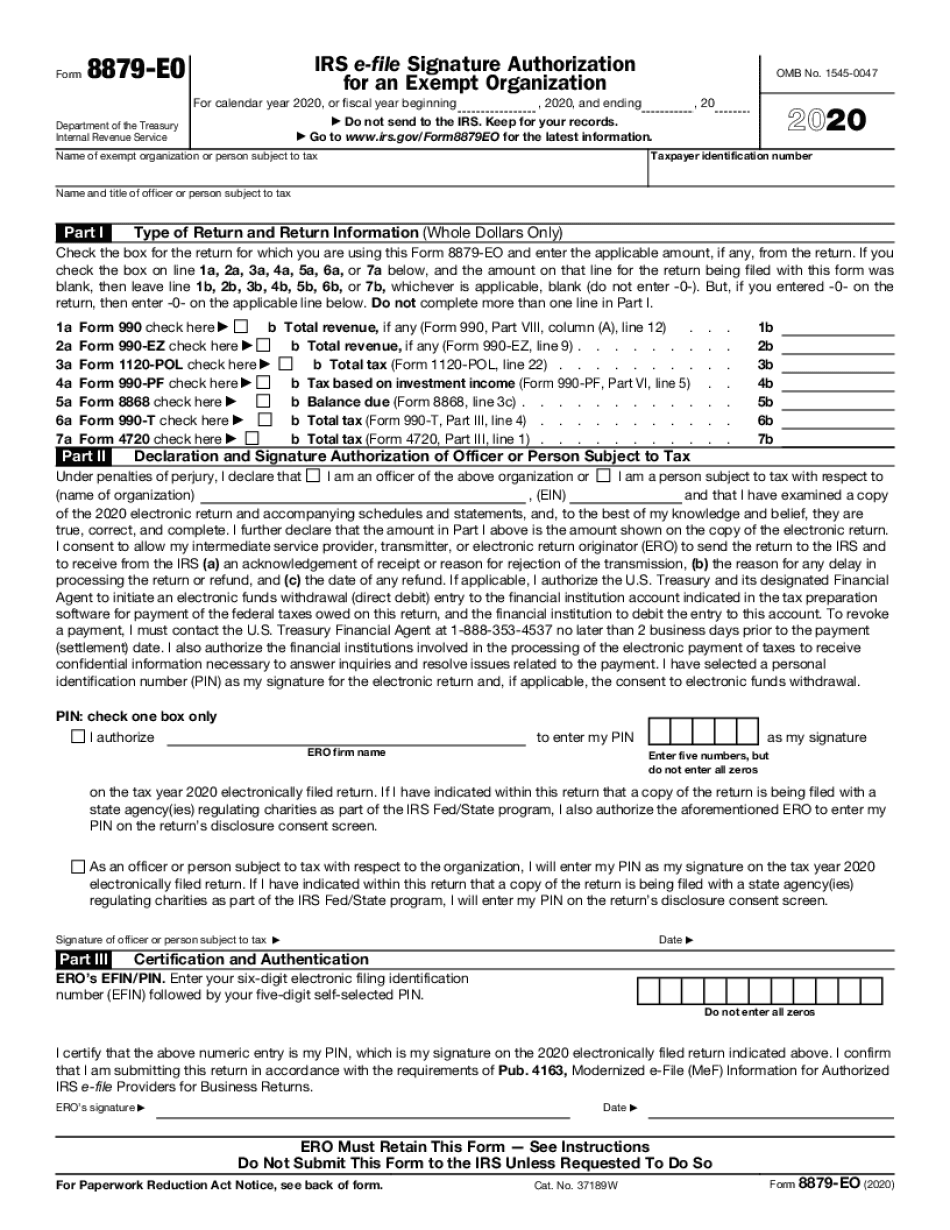

Printable Form 8879-EO New Hampshire: What You Should Know

For additional assistance, please call our Customer Service Center at. The IRS is not responsible for the accuracy, timeliness, or usefulness of any content, or for errors contained in this website. Please be advised that electronic documents may contain typographical errors, omissions, or other errors or inconsistencies that affect the display of the online document. Due to the complexities of tax law, there may be an impact on the filing obligations of some taxpayers depending on the circumstances. The following instructions are applicable to the application of these new tax rules to tax returns filed with the Maine Division of Corporations. If the Corporation or Fund is a business or a non-profit organization, the Corporation or Fund must be organized and established either in the state where the principal place of business is located or outside the state. A corporation may have a branch or part that is located or carried on in the state, and a part that is located or carried on outside the state but conducts its business within the state. The following are examples: (1) an agricultural cooperative, (2) a trade school, (3) a school of music, (4) a hospital, library, or museum, (5) a credit union, (6) a hospital, (7) a nursing home, (8) a professional athletic association, or (9) any other business that conducts most of its business within the state and at least 50% of its business outside the state of business, may be taxed in the same manner as a corporation. See paragraph 7, below. For the purpose of determining tax liability, corporations generally are treated as having a place of business in Maine. To the extent that any part of the corporation's activities in Maine is conducted outside the state, it may be taxed in Maine, and its tax liability will depend on how much of those activities are in the state and how much of the total of the corporation's activities are outside the state. The following is intended to summarize the general rule: (1) If a corporation is based outside Maine and has the principal place of business in Maine, it is taxed as a Maine taxable corporation. But, the corporation will not be subject to the minimum personal income tax required to be collected by Maine. See paragraph 4, below.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8879-EO New Hampshire, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8879-EO New Hampshire?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8879-EO New Hampshire aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8879-EO New Hampshire from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.